Onnilaina: Powerful Smart Lending for Fast Online Loans

In a world where time is money and convenience reigns supreme, the need for quick and reliable financial solutions has never been greater. Enter Onnilaina a groundbreaking platform that’s shifting the paradigm of online lending. Imagine being able to secure a loan with just a few clicks, all while enjoying competitive rates and unparalleled customer support. Whether you’re looking to fund a small business venture or manage unexpected expenses, Onnilaina promises an experience that’s smart, fast, and trustworthy. But what exactly sets it apart in today’s crowded lending landscape?

Let’s dive into the innovative features that make Onnilaina stand out from the rest.

What is Onnilaina

Onnilaina is a cutting-edge online lending platform designed to simplify the borrowing process for individuals and businesses alike. With its user-friendly interface, it caters to those seeking financial assistance without the hassle of traditional banks.

At its core, Onnilaina utilizes advanced technology to assess creditworthiness quickly. This allows borrowers to access funds promptly when they need them most.

The platform offers various loan options tailored to diverse needs, from personal loans to small business financing. It’s all about flexibility in an ever-changing financial landscape.

Additionally, Onnilaina prides itself on transparency and customer support. Users can navigate their options with clear information at every step, making informed decisions easier than ever before. In a world where time is essential, Onnilaina stands out as a beacon of efficiency and reliability in online lending.

Also Read: Awius: Powerful Innovation Redefining Smart User Solutions

How Does it Work?

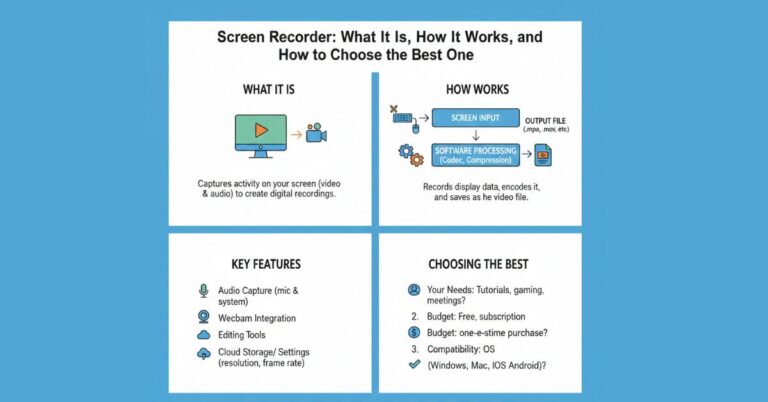

Onnilaina operates with a straightforward and user-friendly model. Users begin by visiting the Onnilaina website or app, where they can quickly register for an account.

Once registered, applicants fill out a simple online form that collects essential information such as income, employment status, and desired loan amount. This process takes only minutes.

After submission, advanced algorithms assess the application against various criteria to determine eligibility. The system ensures quick processing times without compromising on accuracy.

If approved, users receive multiple offers tailored to their financial needs. They can compare interest rates and terms before making a decision.

Funds can be disbursed almost instantly upon agreement of terms. With this seamless approach, Onnilaina transforms traditional lending into a fast-paced digital experience—tailored for today’s fast-moving world.

The Benefits & Features of Onnilaina

Onnilaina stands out in the crowded online lending space, offering a seamless experience for borrowers. Its user-friendly interface allows individuals to navigate effortlessly through the application process.

Security is a top priority. Onnilaina employs advanced encryption technology to protect sensitive information. This builds trust and confidence among users looking for financial assistance.

Quick approvals set Onnilaina apart from traditional lenders. Many applicants receive decisions within minutes, ensuring that urgent needs are addressed promptly.

Flexibility is another key feature of Onnilaina’s offerings. Borrowers can choose repayment terms that suit their budgets, making it easier to manage finances without added stress.

Transparency shines through every transaction on Onnilaina’s platform. There are no hidden fees or unexpected charges, allowing borrowers to plan effectively and avoid surprises down the road.

How Onnilaina is Revolutionizing the Lending Industry

Onnilaina is reshaping the lending landscape by leveraging cutting-edge technology. Its platform streamlines the application process, making it quicker and more efficient than traditional methods.

By utilizing algorithms and data analytics, Onnilaina assesses creditworthiness with precision. This innovative approach reduces barriers for borrowers who may have been overlooked by conventional lenders.

The user-friendly interface ensures that applicants can navigate the loan process effortlessly. With 24/7 access to services, customers can apply anytime, anywhere—eliminating the constraints of office hours.

Moreover, Onnilaina’s commitment to transparency sets a new standard in lending. Users receive clear information about terms and conditions upfront, fostering trust between lenders and borrowers alike.

This transformation is not just beneficial for consumers; it also enhances competition among financial institutions. As more companies adopt similar technologies, the entire industry moves towards greater efficiency and customer satisfaction.

Success Stories from Onnilaina Users

Onnilaina users have shared inspiring stories that highlight the platform’s impact. One entrepreneur, Sarah, turned her passion for baking into a thriving business. With Onnilaina’s quick funding process, she secured a loan within hours to buy new equipment and expand her kitchen.

Another user, Tom, needed urgent medical expenses covered. Traditional banks were slow and unhelpful. He turned to Onnilaina and received approval in no time. This gave him peace of mind during a challenging moment.

Small businesses thrive with Onnilaina’s support as well. Local coffee shops have transformed their operations by accessing funds swiftly through the platform.

These experiences demonstrate how Onnilaina is not just facilitating transactions but empowering lives across various sectors.

Tips for Using Onnilaina to Secure a Loan

To maximize your chances of securing a loan through Onnilaina, start by preparing your financial documents. Ensure you have all necessary paperwork ready and organized. This might include income statements, bank statements, and identification.

Next, check your credit score before applying. Understanding where you stand can help in setting realistic expectations for loan terms.

When using Onnilaina’s platform, take advantage of the intuitive interface. Navigate through the options carefully to find loans that best fit your needs without rushing.

Don’t hesitate to ask questions if something is unclear. Customer support is there to assist you with any uncertainties throughout the process.

Consider multiple offers before making a decision. Comparing different rates allows you to choose the most favorable option tailored to your financial situation.

The Future of Onnilaina and the Online Lending Market

The future of Onnilaina looks promising as the demand for online lending continues to grow. Consumers increasingly prefer quick and accessible loan options, making platforms like Onnilaina essential in today’s financial landscape.

With advancements in technology, we can expect even faster processing times. Machine learning algorithms could help assess creditworthiness more accurately, leading to better loan offers tailored to individual needs.

Moreover, regulatory changes may pave the way for greater transparency within the industry. This shift will likely foster trust among borrowers while promoting responsible lending practices.

As competition intensifies, innovation will drive improvements in user experience. Features such as real-time tracking of applications and personalized customer service are on the horizon.

Onnilaina aims not just to adapt but lead this evolution by enhancing its platform’s capabilities. The synergy between technological progress and consumer expectations is bound to reshape how loans are accessed and managed moving forward.

Conclusion

Onnilaina is paving the way for a new era in online lending. With its user-friendly interface and innovative technology, it offers borrowers an efficient pathway to secure loans quickly and responsibly. As more individuals discover the benefits of Onnilaina, the platform continues to build trust through successful transactions and positive experiences.

The future looks bright for Onnilaina as it adapts to changing market demands and consumer needs. Its commitment to reliability, speed, and smart solutions ensures that it remains at the forefront of the online lending industry. Embracing this evolution not only enhances financial accessibility but also empowers users with knowledge about their borrowing options.

As Onnilaina grows, so too does its potential impact on how we perceive lending as a whole—a shift towards transparency and efficiency that prioritizes customer satisfaction above all else. The journey has just begun; stay tuned to see how this remarkable service will continue transforming finance for individuals everywhere.

Stay updated with all our recent articles — visit true realty value today.